The Better the Training, The Better the Outcomes: Why Excellence in Commercial Drone Education Matters

Canada’s commercial drone industry stands at a pivotal moment. With over 115,728 registered drones and more than 147,000 drone pilots nationwide as of Nov. 3, 2025, the market has evolved from experimental technology to essential business infrastructure. The Canadian drone market reached $4.1 billion in 2024 and projects growth to nearly $10 billion by 2030, with commercial operations representing 25 percent of all registered systems. Yet amid this explosive expansion lies a critical truth: the quality of operator training directly determines not just program success, but operational safety, return on investment, and long-term viability.

The Real Cost of Inadequate Training

Canadian aviation safety data reveals training’s critical importance. Between 2005 and 2016, Transport Canada’s Civil Aviation Daily Occurrence Reporting System documented 355 drone-related incidents in Canadian airspace, with incidents increasing markedly after 2013. The Transportation Safety Board of Canada received 30 reports between 2014 and 2017 of pilots observing drones on their flight path, alongside eight additional incidents involving drones but not manned aircraft. One such incident in Beloeil, Quebec saw a recreational drone fall from 25 to 50 feet and strike a spectator at an outdoor event—demonstrating how training failures translate directly into public safety risks.

The incident data reveals troubling patterns. Of 270 incidents with reported drone altitude, 80.4 percent occurred above the 400-foot regulatory ceiling, and 62.6 percent occurred above 1,000 feet—clear violations stemming from insufficient regulatory knowledge. Of 268 incidents with reported horizontal distance to the nearest aerodrome, 74.6 percent occurred within five nautical miles, with 92.4 percent and 76.6 percent reported above 1,000 feet and 3,000 feet respectively. These aren’t equipment failures—they’re training failures that put manned aircraft, their passengers, and people on the ground at risk.

The October 2017 collision between a Beechcraft King Air and a drone near Quebec City’s Jean Lesage International Airport exemplifies these risks. The aircraft, carrying two pilots and six passengers, struck a drone at 2,500 feet altitude—well within controlled airspace where drone operations require authorization. The investigation could not identify the operator, no Special Flight Operations Certificate had been issued for the airspace, and no Notice to Airmen had been filed. While the aircraft sustained only minor damage and landed safely, the incident revealed a fundamental training gap: operators who either don’t understand or choose to ignore the regulatory framework that keeps Canadian skies safe.

Training as Strategic Investment, Not Operational Expense

Forward-thinking Canadian organizations recognize that comprehensive training transforms drone programs from cost centres into profit generators. The evidence from comparable markets is compelling. Construction firms using properly trained drone operators for surveying have reported savings of $1.7 million on single projects through reduced traditional surveying costs and minimized project delays. Agricultural operations achieve 60 percent reductions in targeted crop treatments through trained drone-based monitoring programs—particularly relevant given that Saskatchewan alone accounts for nearly 40 percent of Canada’s arable land.

Canada’s commercial drone market demonstrates this ROI potential across sectors. The agriculture drone segment alone is projected to grow from $261.5 million in 2024 to $999.2 million by 2030—a compound annual growth rate of 25.4 percent. This growth is supported by government initiatives including the Canadian Agricultural Partnership, a five-year $3 billion investment that includes funding for precision agriculture technologies. Utility companies leveraging trained operators for power line inspections reduce inspection time by over 60 percent while cutting labor costs by nearly 30 percent.

With proper training, drone businesses typically achieve return on investment within 12 to 18 months. The time-to-value for well-trained operators using commercial drones is measured in minutes, not months. Conversely, programs built on inadequate training face extended payback periods, higher operational costs, and diminished returns that can doom drone initiatives before they demonstrate value to stakeholders who control capital allocation decisions.

Components of Effective Canadian Drone Training

Quality commercial drone training in Canada extends far beyond basic certification requirements. Comprehensive programs integrate multiple critical components:

- Regulatory Mastery: Understanding Transport Canada regulations and the Canadian Aviation Regulations isn’t about memorizing rules for exams—it’s about internalizing the regulatory framework that enables safe, compliant operations across varying operational contexts. This includes Canadian airspace classification, the NAV Drone authorization system, Special Flight Operations Certificate requirements, and the emerging RPAS Operator Certificate framework for complex operations.

- Technical Proficiency: Operators must understand aircraft systems, weather impacts particular to Canadian conditions (including cold weather operations), emergency procedures, and the technical limitations that define safe operational envelopes. This knowledge prevents the incidents that constitute the majority of reported occurrences.

- Operational Judgment: Training must develop the decision-making skills that separate adequate operators from exceptional ones. This includes risk assessment, contingency planning, and the situational awareness required for complex operations like BVLOS flights or operations near manned aircraft in Canada’s diverse geographic environments.

- Industry-Specific Application: Generic training produces generic results. Quality programs connect drone operations to specific Canadian business outcomes, teaching operators how thermal imaging serves infrastructure inspection workflows in harsh climates, how photogrammetry drives construction progress monitoring in remote locations, or how multispectral sensors enable precision agriculture across Canada’s vast agricultural lands.

- Data Management and Analysis: The drone is merely the collection platform. Trained operators understand how to process, analyze, and present data in formats that drive business decisions. This transforms raw aerial imagery into actionable intelligence that justifies program investment.

Advanced Training for Complex Operations

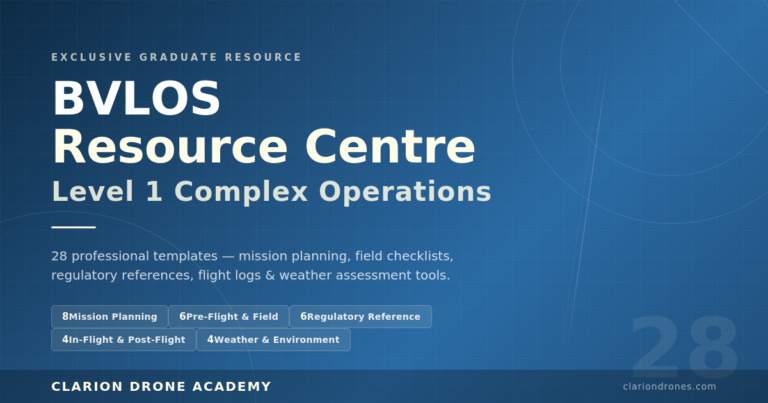

As Canada’s regulatory framework matures, specialized training becomes increasingly critical. The new Level 1 Complex Operations certification, effective November 4, 2025, represents Transport Canada’s recognition that Beyond Visual Line of Sight operations require fundamentally different skill sets than visual operations. This certification allows BVLOS flights for small and medium drones in lower-risk scenarios: staying in uncontrolled airspace, operating below 400 feet above ground level, and maintaining at least five nautical miles distance from aerodromes.

The training requirements reflect BVLOS operations’ fundamental difference from visual flight. To obtain Level 1 Complex certification, pilots must be at least 18 years old, pass a specialized online exam covering topics beyond basic and advanced operations, complete 20 hours of instructor-led training, and pass a comprehensive flight review. Organizations conducting BVLOS operations must obtain an RPAS Operator Certificate by declaring compliance with training, maintenance, and risk-management programs appropriate to their operational scale and complexity.

This regulatory evolution mirrors proven aviation safety principles. Visual operations require maintaining eye contact with the aircraft; BVLOS demands interpreting data streams, responding to automated alerts, and managing operations through technological interfaces rather than direct observation. This shift requires different cognitive skills, risk assessment frameworks, and decision-making processes that must be deliberately developed through specialized training programs—not assumed to transfer from visual flight experience.

Government, military, and First Nations clients particularly demand this advanced training. These operations often involve sensitive infrastructure, security considerations, and complex regulatory frameworks that require operators who understand not just drone technology, but the broader operational context. First Nations land management operations, for instance, require cultural awareness and regulatory knowledge specific to Indigenous territories, combined with technical proficiency in forestry applications and environmental monitoring across Canada’s diverse ecosystems.

The Human Element in Automated Systems

Paradoxically, as drone systems become more automated, human training becomes more critical, not less. Industry research shows autonomous systems reduce accidents by approximately 15 percent compared to manual operation, but this improvement depends entirely on operators who understand when to trust automation and when to intervene. The August 2021 incident at Toronto Buttonville Municipal Airport illustrates this principle: a Cessna 172 on training approach encountered a drone, demonstrating that automated systems haven’t eliminated the need for trained human judgment in preventing conflicts.

Canadian aviation safety data offers instructive parallels. Commercial airline operations under CAR’s Part VII, Subpart 705 regulations, with mandatory recurrent training and rigorous certification standards, have achieved exceptional safety records. General aviation, with less stringent training requirements, experiences higher accident rates, with loss of control in flight—a pilot error category—accounting for the majority of serious incidents. The difference lies almost entirely in training standards and recurrent education requirements.

For drone operations in Canada’s challenging environments—from Arctic conditions to dense urban airspace—this means training cannot be a one-time event. Complex operations require continuous skill development and decision-making capabilities that only ongoing education maintains. Whether adjusting flight paths for Canadian weather conditions or safely recovering drones that have lost communication links in remote territories, outcomes depend on the trained operator in control.

Measuring Training Effectiveness Through Canadian Standards

Organizations should evaluate training programs through concrete business outcomes aligned with Transport Canada compliance requirements, not just completion certificates. Effective measurement frameworks track multiple indicators. Safety metrics include incident rates reportable to the Transportation Safety Board, near-miss incidents, and compliance with Canadian Aviation Regulations. Operational metrics measure mission success rates, data quality scores, and operational efficiency gains. Financial metrics capture ROI timelines, cost savings versus traditional methods, and revenue generation from drone-enabled services.

Leading Canadian organizations formalize ROI measurement in ways reflecting their priorities. Whether reduced wildfire risk in British Columbia forests, improved emergency response in remote territories, or streamlined infrastructure maintenance across vast distances, enterprises should document outcomes in repeatable ways that align with organizational goals. This evidence-based approach justifies continued investment in training and demonstrates value to stakeholders who may initially view training as a discretionary expense rather than a strategic necessity in an increasingly competitive market.

The Canadian market data consistently shows that training quality correlates directly with program success and market capture. The commercial drone market is projected to grow from $3.3 billion in 2024 to $5.1 billion by 2030 at a 7.2 percent compound annual growth rate. Organizations with comprehensive training programs position themselves to capture disproportionate market share as regulatory frameworks evolve and clients increasingly demand demonstrated operational excellence and safety records.

Conclusion: Training as Competitive Advantage in Canadian Markets

As Canada’s drone industry matures from emerging technology to established business tool, training separates successful programs from failed initiatives. The Transportation Safety Board’s incident data makes clear that the primary reason drone programs fail isn’t technology limitations or equipment costs—it’s inadequate planning for what the program should achieve and insufficient training to execute that vision while maintaining compliance with Canadian regulations.

The regulatory changes taking effect November 4, 2025 raise the training bar significantly. The new Level 1 Complex Operations certification, RPAS Operator Certificate requirements, and technical standards for drones create clear demarcation between organizations that invested in comprehensive training and those treating certification as a checkbox exercise. Organizations investing now in programs that exceed minimum Transport Canada requirements will possess competitive advantages when routine BVLOS operations become normalized across Canadian airspace.

The message is clear: better training produces better outcomes across every meaningful dimension—safety, efficiency, profitability, regulatory compliance, and scalability. In an industry where standing still represents the costliest risk, investing in comprehensive, ongoing training isn’t just prudent—it’s essential for organizations serious about capturing market share in Canada’s rapidly growing drone economy.

The choice facing Canadian commercial drone operators is straightforward: invest in training excellence today, or pay the considerably higher price of inadequate preparation tomorrow. The Transportation Safety Board data, Transport Canada’s regulatory trajectory, and market growth projections all point toward the same conclusion—in commercial drone operations across Canada, training quality determines everything.

References

1. Canadian Science Publishing. (2017). Reported UAV incidents in Canada: Analysis and potential solutions. Journal of Unmanned Vehicle Systems. Retrieved from https://cdnsciencepub.com/doi/abs/10.1139/juvs-2016-0033

2. CBC News. (2019, August 21). Near collisions between drones and airplanes on the rise. Retrieved from https://www.cbc.ca/amp/1.5238767

3. Deep Market Insights. (2025, October 27). Canada commercial drone market size & share report by 2033. Retrieved from https://deepmarketinsights.com/vista/insights/commercial-drone-market/canada

4. Gitnux. (n.d.). Drone accident statistics: Market data report 2025. Retrieved from https://gitnux.org/drone-accident-statistics/

5. Grand View Research. (2024, August 28). Canada drone market size & outlook, 2024-2030. Retrieved from https://www.grandviewresearch.com/horizon/outlook/drone-market/canada

6. Grand View Research. (2025, October). Canada commercial drone market size & outlook, 2030. Retrieved from https://www.grandviewresearch.com/horizon/outlook/commercial-drone-market/canada

7. Grand View Research. (2025, April 8). Canada military drone market size & outlook, 2024-2030. Retrieved from https://www.grandviewresearch.com/horizon/outlook/military-drone-market/canada

8. Grand View Research. (2025, May 15). Canada agriculture drones market size & outlook, 2030. Retrieved from https://www.grandviewresearch.com/horizon/outlook/agriculture-drones-market/canada

9. Grow Trade Consulting. (2025, May 14). Canada market spotlight: Drones. Retrieved from https://growtrade.ca/2025/05/21/canada-market-spotlight-drones/

10. IMARC Group. (n.d.). Canada drones market 2033. Retrieved from https://www.imarcgroup.com/canada-drones-market

11. Market Research Future. (2025, March 26). Canada drones market size, share, trends by 2035. Retrieved from https://www.marketresearchfuture.com/reports/canada-drones-market-44633

12. SmartDrone. (2024, May 17). The financials explained: ROI of drone integration. SmartDrone Blog. Retrieved from https://blog.smartdrone.us/insights/the-financials-explained-roi-of-drone-integration

13. Transport Canada. (2025). 2025 summary of changes to Canada’s drone regulations. Retrieved from https://tc.canada.ca/en/aviation/drone-safety/2025-summary-changes-canada-drone-regulations

14. Transport Canada. (n.d.). Drone operation categories and pilot certificates: Level 1 complex operations. Retrieved from https://tc.canada.ca/en/aviation/drone-safety/learn-rules-you-fly-your-drone/drone-operation-categories-pilot-certificates/level-1-complex-operations

15. Transport Canada. (n.d.). Drone pilot licensing. Retrieved from https://tc.canada.ca/en/aviation/drone-safety/drone-pilot-licensing

16. Transport Canada. (n.d.). Drone safety. Retrieved from https://tc.canada.ca/en/aviation/drone-safety

17. Transport Canada. (n.d.). Find your drone category of operation (2025). Retrieved from https://tc.canada.ca/en/aviation/drone-safety/learn-rules-you-fly-your-drone/find-your-drone-category-operation-2025

18. Transport Canada. (n.d.). Getting a drone pilot certificate. Retrieved from https://tc.canada.ca/en/aviation/drone-safety/drone-pilot-licensing/getting-drone-pilot-certificate

19. Transport Canada. (n.d.). Knowledge requirements for pilots of remotely piloted aircraft systems, 250 g up to and including 150 kg, basic and advanced operations (TP 15263). Retrieved from https://tc.canada.ca/en/aviation/publications/knowledge-requirements-pilots-remotely-piloted-aircraft-systems-250-g-including-150-kg-basic-advanced-operations-tp-15263

20. Transportation Safety Board of Canada. (2017). Aviation investigation report A17Q0162: In-flight collision with drone. Retrieved from https://www.tsb.gc.ca/eng/rapports-reports/aviation/2017/a17q0162/a17q0162.html

21. Transportation Safety Board of Canada. (2021). Air transportation safety investigation report A21O0069. Retrieved from https://www.tsb.gc.ca/eng/rapports-reports/aviation/2021/a21o0069/a21o0069.html

22. Transportation Safety Board of Canada. (n.d.). Report an air transportation occurrence. Retrieved from https://www.bst.gc.ca/eng/incidents-occurrence/aviation/index.html