Canada’s BVLOS Infrastructure Crisis: Why We Cannot Afford to Lose Foremost

Canada stands at a critical crossroads in drone technology development. As the Canadian drone market surges toward $9.9 billion by 2030 with projected annual growth of 16%, the nation faces an infrastructure crisis that threatens to undermine this expansion. The Foremost Unmanned Aircraft Systems Test Range, one of only two Transport Canada-approved Beyond Visual Line of Sight testing facilities in Canada, closed operations on September 30, 2025 when federal and provincial funding expired. Without immediate action to secure $200,000 in annual operating funds, this vital national asset may never reopen, forcing Canadian drone innovation abroad and ceding market leadership to international competitors.

The Strategic Importance of BVLOS Testing Infrastructure

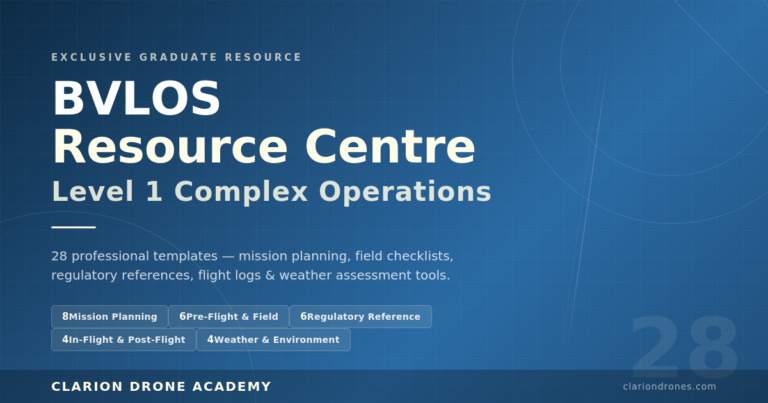

Beyond Visual Line of Sight operations represent the future of commercial drone applications. Transport Canada’s November 4, 2025 regulatory framework introduced Level 1 Complex Operations certification, eliminating the Special Flight Operations Certificate requirement for routine BVLOS flights in sparsely populated areas. This regulatory advancement creates unprecedented opportunities for wildfire monitoring, medical supply delivery, infrastructure inspection, and emergency response across Canada’s vast geography. However, regulatory permission means nothing without testing infrastructure to validate systems and train operators.

The Foremost range offers 2,400 square kilometres of Class F restricted airspace, nearly four times the size of Banff National Park. This segregated airspace provides what few facilities in North America can deliver: the freedom to conduct extended BVLOS testing without visual observers, radar coordination complexities, or population density constraints. Companies developing detect-and-avoid technology, autonomous navigation systems, and long-endurance platforms require this environment to prove their capabilities before deploying in shared airspace.

NAV Canada’s Dependence on Foremost

Alan Chapman, NAV Canada’s Director of RPAS Traffic Management, stated that Foremost provided the backbone for testing capabilities that informed Canada’s new drone regulations. The facility’s role extended beyond private sector development to include regulatory validation work. NAV Canada processes over 1,000 flight authorization requests weekly, and the systems validating these requests were tested at Foremost. Losing this capability means losing the infrastructure that ensures Canada’s airspace integration systems actually work in real-world conditions.

Economic Consequences of Facility Closure

The Canadian commercial drone market generated $3.3 billion in revenue in 2024, with projections reaching $5.1 billion by 2030. Military drone spending adds another $3.1 billion annually, growing to $7.5 billion by 2030. Agricultural drone applications alone represent $261.5 million in 2024, expanding to nearly $1 billion by 2030 as Saskatchewan’s vast farmlands adopt precision agriculture technologies. These growth projections assume Canadian companies can develop and validate their technologies domestically.

Without Foremost, Canadian drone manufacturers face three options: relocate BVLOS testing to Alma, Quebec (the only other certified Canadian facility with tighter altitude restrictions and limited activation windows), send testing operations to international facilities in the United States or Europe, or abandon BVLOS capability development entirely. Each option damages Canada’s competitive position. The Alma facility cannot absorb Foremost’s capacity, international testing adds cost and delays that favour foreign competitors, and abandoning BVLOS development concedes trillion-dollar markets in autonomous delivery, infrastructure monitoring, and emergency response.

Defence and Security Implications

Foremost’s proximity to the U.S. border provides unique strategic value for defence applications. The facility offers capabilities for testing long-endurance surveillance drones that could monitor critical infrastructure, support border security operations, and validate military UAV systems in realistic operational environments. Range safety officer Steve Donovan noted that border patrol agencies could deploy drones with 12-hour endurance from this location. With Canada’s Department of National Defence exploring uncrewed combat drones to complement the F-35 fleet, losing domestic testing capacity for these systems represents a national security vulnerability.

The Infrastructure Development Challenge

The Foremost team spent eight years navigating Transport Canada approvals, NAV Canada coordination, and landowner agreements to establish this facility. This timeline illustrates why closing Foremost cannot be reversed by simply funding a replacement later. The complex regulatory coordination, airspace designation processes, and stakeholder engagement required to create Class F restricted airspace of this scale represents irreplaceable institutional knowledge and relationships.

Western Economic Diversification Canada invested $1.1 million from 2015 to 2018 in initial infrastructure and safety system upgrades that enabled Transport Canada’s BVLOS certification. The province of Alberta contributed over $750,000 through various grants. This cumulative $1.85 million investment now sits idle because annual operating funds of $200,000 cannot be secured. The economics are stark: the annual operating cost represents just 10.8% of the capital already invested. Put differently, for every dollar spent on annual operations, Canada preserves $9.25 of infrastructure investment. More critically, this facility required eight years of regulatory approvals and stakeholder coordination that cannot be replicated at any cost.

Regulatory Timing and Industry Readiness

Transport Canada’s November 2025 regulatory updates created the framework for routine BVLOS operations, introducing Level 1 Complex certification for lower-risk operations and eliminating SFOC requirements for specific operational parameters. Canadian operators are now achieving certification under this framework, demonstrating industry readiness to capitalize on regulatory advancement. However, regulatory permission without testing infrastructure creates a bottleneck where certified operators cannot validate new technologies or expand operational capabilities.

The timing of Foremost’s closure could not be worse. As Transport Canada implements the most significant regulatory advancement for BVLOS operations in Canadian aviation history, the infrastructure needed to support this expansion stands vacant. The Canadian industry competed for regulatory modernization and achieved it, only to lose the testing capacity required to exploit the opportunity.

A Call to Action: Three Critical Steps

Canada’s drone industry, regulatory authorities, and government officials must act immediately to preserve this national asset. First, Transport Canada and Innovation, Science and Economic Development Canada should establish emergency operating funding of $200,000 annually while developing a sustainable long-term funding model. Second, the facility should be designated as critical innovation infrastructure under Canada’s National Research Council Industrial Research Assistance Program, providing operational stability and recognizing its role in regulatory development.

The village of Foremost and facility manager Doug Hanna have demonstrated commitment by maintaining operations despite funding uncertainty. Federal and provincial governments must match this commitment with financial support that reflects the facility’s strategic value. The alternative—rebuilding this capability years from now at exponentially higher cost—represents fiscal irresponsibility and strategic incompetence.

Conclusion: Choose Leadership or Accept Decline

Canada can lead in BVLOS drone operations or watch this market opportunity transfer to nations that prioritize innovation infrastructure. The Foremost facility represents decades of work by Transport Canada, NAV Canada, industry stakeholders, and local communities to create world-class testing capacity. Allowing this asset to close for $200,000 in annual funding while the Canadian drone market grows toward $10 billion annually demonstrates a failure of strategic thinking that will disadvantage Canadian innovation for decades. Government officials must recognize that infrastructure supporting trillion-dollar markets deserves investment measured in hundreds of thousands, not abandonment. The decision is simple: fund Foremost now or explain to the next generation why Canada surrendered leadership in one of the 21st century’s most important technology sectors.

References

- CBC News. (2025, December 5). One of Canada’s top drone test sites may shut down in spring. Retrieved from https://www.cbc.ca/news/canada/calgary/foremost-drone-test-site-alberta-9.7003229

- Government of Canada. (n.d.). Test range makes Alberta a hub of unmanned aerial vehicle (drone) technology. Retrieved from https://www.canada.ca/en/prairies-economic-development/campaigns/success-stories/alberta/test-range-hub-unmanned-aerial-vehicle-drone-technology.html

- Canadian Science Publishing. (2023, August 11). Beyond visual-line-of-sight (BVLOS) drone operations for environmental and infrastructure monitoring: a case study in northwestern Canada. Journal of Unmanned Vehicle Systems. Retrieved from https://cdnsciencepub.com/doi/10.1139/dsa-2023-0012

- CBC News. (2017, June 6). ‘It’s the future’: Small prairie village pins economic fortunes on drones. Retrieved from https://www.cbc.ca/news/business/foremost-uav-drones-1.4146655